You won't Believe this is a Small-Cap Stock 🤯

Learn more about one of the most incredible businesses we've explored to date.

Microchips or semiconductors are often underestimated entities because they are practically invisible in our daily lives.

But even though we may never interact with them directly, their relevance and significance in today’s world should never go underappreciated.

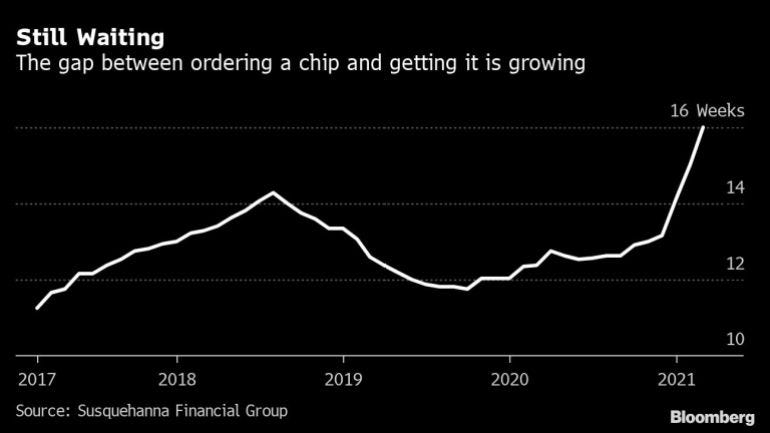

This was never more true than during the major chip shortage that plagued 2021 and is still causing strain in 2022.

As a quick reminder, more than $500 billion in revenues was lost due to a lack of microchip supply during that time.

Although some pain was felt, the tight economic environment created an excellent opportunity for many semiconductor businesses to grow and solidify themselves in a highly specialized market.

With demand surging and margins widening, the microchip market became a cash flow machine, producing valuable capital on a scale never seen before.

And while all of this is happening, one particular small-cap company benefited far greater than the rest.

You wouldn’t believe me if I told you this was a business worth less than $2 billion, but here we are, an absolute diamond of a company:

🏆 Ranked a Top 10 Fabless IC Design Company (globally) by TrendForce

💰 Over $380 million in free cash flow generated in 2021, with a market cap of only $1 billion

📊 40% market share (globally) of the Driver IC for automotive displays.

To find out who we chose, continue reading below.

🚨 If you want to learn more about small-cap investing and what makes it an excellent investment strategy, check out our “What is a Small-Cap Stock” article on our website @ EdgeInvestments.org.

A Quick Recap

Two weeks ago, we shared with you our deep dive into the semiconductor industry at large and offered five small-cap stocks shaking up the market.

Now that some time has passed, we are ready to settle the debate once and for all by giving you our pick for the best microchip small-cap.

But before we do, here is our company comparable table so that you may decide whether we are hustling you or not.

🚨 For more information on the runner-ups, check out our previous newsletter on the semiconductor industry.

And the Winner Is…

It is hard to believe that all of these businesses are small-cap stocks based on the numbers.

With each of them demonstrating consistent growth, healthy balance sheets, and phenomenal capital allocation (as per their ROE), financial health alone won’t cut it for this small-cap microchip assessment.

Instead, what we chose to focus on during our selection process was primarily value, management capabilities, and the market runway ahead.

Since the semiconductor industry is highly segmented with many specialized niche markets, not all businesses have as favorable an opportunity for growth.

Take Photronics for example.

They are masters at designing and producing photomasks, a key component in the semiconductor manufacturing process, yet their entire market is worth only $4.52 billion.

At a forecasted CAGR of 3.8% over the next few years, the growth potential of this business isn’t spectacular even though it already owns an impressive 14.69% market share.

While this is just one example, it is good because it demonstrates how we weigh investment options and what it takes to be the best of the best in the small-cap world.

So without any further delay, Edge Investments’ winner for the number one small-cap semiconductor stock is…

Himax Technologies (HIMX)

Himax is without a doubt a wonderful business.

As one of the leading manufacturers of display drivers for LCD screens, Himax offers a strong portfolio of products and has established many valuable partnerships with highly acclaimed businesses including Samsung, Amazon, and LG.

Given this position, the company generated revenues of $1.55 billion, free cash flows over $380 million, and an ROE of 61.15% in 2021, while being valued at a market capitalization of $1.086 billion.

With both a very healthy balance sheet and a competent management team, this Taiwanese fabless semiconductor company is considered undervalued in comparison to its competitors, and well-positioned to endure the poor economic conditions ahead.

Learn more by reading below.

🚨 If you are enjoying this newsletter, please share and subscribe so that we may deliver more value to our audience.

Himax Technologies Three Edges and a Risk

Edge #1: Massive Market Share in Multiple Markets

Over the years, Himax successfully obtained a large position in multiple Driver IC markets, including automotive (38.3%), tablets (34.0%), and large panel displays (9.4%), such as televisions.

By gaining the trust of its customers and building a well-respected brand, the company established itself as one of the leading manufacturers in the display driver market; Himax’s global driver market share is 10%.

While Himax certainly explores acquisition opportunities, the main driver of its growth is through improvements in its value offering, rather than by scaling the business.

As such, the company successfully solidified its place within the industry by decreasing costs for its customers, improving the quality of the products, and building a more effective distribution network.

All-in-all, Himax is expected to maintain its market position due to these factors and more.

With such a diversified product offering, the business should thrive well into the future.

Edge #2: Strong alignment between management and shareholders

One of the most important considerations when investing in individual stocks, especially small-caps, is knowing whether or not management is properly aligned with its shareholders.

While there are various strategies for assessing the intentions of a management team, a few of the most valuable ones to consider are the following:

How large of a position do insiders hold?

How long has the current management (CEO) been in place?

How effective are they in allocating the corporation’s capital?

In this case, Himax easily checks all three boxes.

🤝 Insider Ownership: 31.50%

⏰ CEO tenure: Jordan Wu has been the President, CEO, and Director of Himax since 2005

🧠 Ability to allocate capital: 61.15% Return on Equity

As you can see, Himax’s management team is strongly aligned given that they make up over 30% of ownership and maintained the same CEO for over 17 years.

In a world where quick time horizons dominate investor sentiment, knowing that the leader of a company you are invested in, is in it for the long haul, is a promising indication to shareholders that the board is focused on the long-term growth of the business, not short-run profits.

Since you are most likely to realize the best returns as an investor when you plan to hold a business forever, a management team who intends to do the same will offer you the best chance for success.

Edge #3: Strong cash position and effective R&D

Part of Himax Technologies’ competitive advantage exists in its ability to innovate and produce more advanced semiconductor solutions than its competitors.

To do so, the company requires a lot of upfront investment which is channeled through its research and development; in 2021, Himax spent $151 million on R&D.

Fortunately, with such a strong cash position, the business can take on more risk than most competitors in this aspect because there are limited threats to disrupting the business’ core operations.

With such consistent revenue streams, Himax can invest more into its growth even if some of its new endeavors don't pan out.

One such example of a successful venture is Himax’s 3D sensing solution, SLiM, which is used in a variety of applications including VR technology, medical inspections, and e-payments.

The possibilities are endless when you have a stockpile of cash at your disposal.

Risk: Concentrated operations in a high-risk region

Given the geopolitical tension between the US and China, regarding Taiwan, Himax’s largely established position within Taiwan, and the Asian-Pacific region, may pose a significant threat to the business if the tension between the two superpowers turns into a conflict.

While they are diversified into the United States to some extent, experiencing major disruptions to your operations is never ideal.

Since little is unknown about how these tensions will play out, investors in Himax Technologies bear additional risk than your conventional stock because of the increased uncertainty when owning this business.

That being said, when you consider the strength of the business and its current valuation, one should at least flirt with the idea of purchasing this incredible small-cap stock.

🚨 Want to learn about how to make money with small and micro-cap stocks? Check out our article on “How to Make Money With Penny Stocks”

This newsletter is written by Kevan Matheson, Founder & CEO of Edge Investments.

Before starting Edge, Kevan was an Institutional Analyst at RBC Global Asset Management, one of North America’s largest fund managers, with assets under management in excess of $400 billion.

After spending the majority of his career focused on large market capitalization public companies, Kevan became attracted to the risk/reward proposition of growth stocks and cryptocurrency.

In 2017 Kevan published a book on investing in cryptocurrency, where he speculated on the coming growth in NFTs and the underlying tokens that power their ecosystems.

Known in the growth stock community as Small Cap Kev, his current passion is finding stocks in disruptive industries like blockchain, psychedelic medicine, plant-based meat alternatives & much more.

This article was written in collaboration with Edge Investments’ analyst & writer, Declan O’Flaherty

Declan holds a Bachelor of Commerce from the University of Alberta and has over 2 years of experience investing in financial markets.

As a value investor, Declan embraces the lessons of Warren Buffett and his disciples when making investing decisions. With an emphasis on business fundamentals, his strategy focuses on finding stocks with excellent management, a competitive advantage, and those that are selling at discount to their real value.