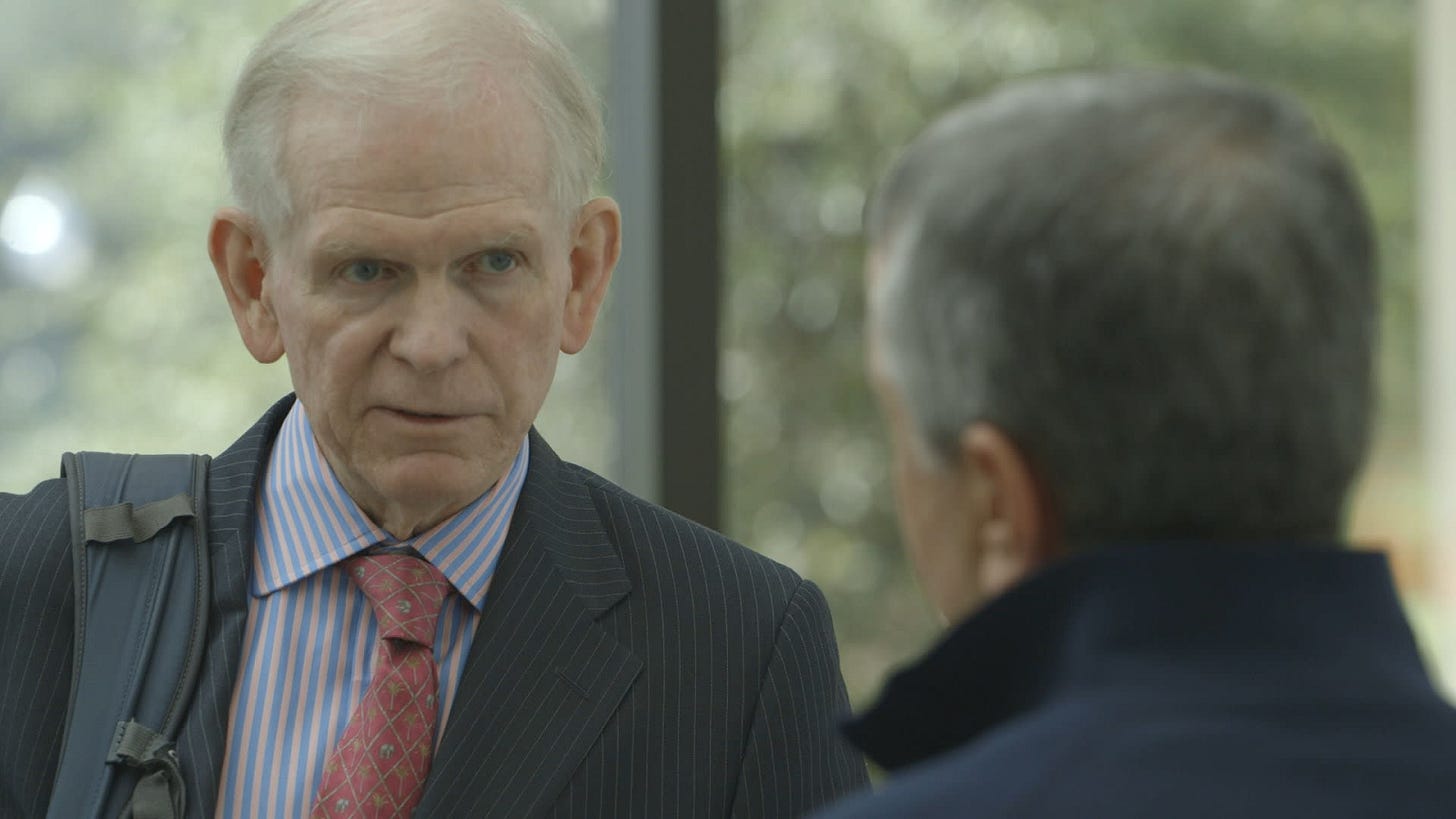

📸 Legendary Investor Jeremy Grantham’s Final Warning

Plus, the Ethereum Merge Will Change the Game Forever

This Newsletter is brought to you by…

VERSES Technologies (NEO: VERS) is a next-generation AI company creating smart cities using spatial web technology to improve various systems like distribution & warehousing, shipping & logistics, agriculture, and more!

Recently, VERSES received DTC eligibility, thus improving its accessibility to shareholders and investors.

💻 The DTC manages the electronic clearing and settlement of publicly traded companies which accelerates the settlement process for investors and brokers and enables VERSES to trade over a much wider selection of brokerage firms.

🌎 VERSES’ CEO Gabriel Rene explained, “Obtaining DTC eligibility represents the Company's commitment to increasing visibility and accessibility for all its shareholders in the United States. It enables VERSES to expand our reach to a larger portion of the global investment community while providing a more efficient and seamless trading process for a wider array of investors.”

📲 VERSES also submitted an application to list on the OTCQX, expanding access in the US, and will provide an update on the listing in the coming months.

For more information on VERSES, check out our recent interview with CEO Gabriel Rene.

A Quick Market Recap

Peeping your portfolio at the end of the week like…

Yikes!

It appears that last week’s rally was short-lived, especially after Tuesday’s sell-off debacle.

With the S&P 500 tumbling 177.72 points, or 4.3%, to 3,932.69 by the end of the day, investors were reminded of the poor economic environment they are facing.

As inflation remains high and interest rates continue to rise, it is becoming increasingly difficult to predict where the markets are headed.

But as they say, “C’est la vie.”

Here is how major indexes performed this week:

🚨 If you enjoy our newsletter, please like & share so that we may deliver more value to our investment community. Thank you for your continued Support!

Top News

Mortgage rates rise to 2008 levels

It is not looking pretty for those looking to sell their homes as fixed-term mortgage rates continue to rise amidst historically high inflation.

Upon the disappointing news that the August CPI climbed to 8.3%, higher than expected, investors and financial institutions are pricing in another aggressive rate hike by the Fed.

📈 The average contract interest rate for 30-year fixed-rate mortgages increased to 6.01% this month, up from 5.94%.

🏚 MBA’s associate vice president Joel Kan said, “The 30-year fixed mortgage rate hit 6% for the first time since 2008 [...] essentially double what it was a year ago.”

📉 In total, mortgage demand has fallen 29% YoY, with refinancing demand declining 83% YoY.

😬 With rates above 6%, only 452,000 borrowers could benefit from a refinance; the lowest number on record.

🏘 COO of Mortgage News Daily, Matthew Graham wrote, “It was one of the last shoes to drop before the Fed announcement on September 21st, and it arrived at a time where the market had fully priced in a 75bp hike.”

🚨 In the event of a major crash, it is best to be prepared. Knowing how to make money with cheap stocks could positively change your life forever. Click the link to learn more about this once-in-a-lifetime opportunity.

Source: Bitcoinist

The Ethereum Merge was a success!

Possibly the most important moment in crypto history, The Merge saw the Ethereum blockchain successfully transition from a Proof-of-Work to a Proof-of-Stake system.

A spectacular engineering feat on its own, the network moved over $175 billion in ETH to the new system without disrupting the blockchain in the process.

🧩 After 1.5 years of testing and development, the time finally came for Ethereum to shift to PoS, meaning that its millions of stakeholders would verify transactions, rather than mining them as they did on the PoW systems.

🌱 The Merge to PoS reduces Ethereum’s energy consumption by 99% and demolishes many of the barriers to entry that once constrained the blockchain.

📊 In addition, The Merge reduces Ethereum’s inflation rate to just 0.49%, meaning that the blockchain will only produce 584 thousand tokens per year; versus the 4.93 million produced on PoW.

✅ As of Thursday, the very first proof-of-stake block of transactions was finalized with a nearly 100% client participation rate. This was, by far, the best-case scenario.

🤔 At the time of writing, Ethereum is down 15.97% this week, trading at a market cap of $168.16 billion.

🚨 Want to know what we think? Check out our in-depth newsletter on The Ethereum Merge.

Investor Jeremy Grantham warns the S&P 500 could plunge another 26%

It is no surprise that markets are extremely volatile at this time, but renowned investor Jeremy Grantham argues that the worst has yet to come.

😱 In a recent interview, Grantham argues, “the deterioration in fundamentals on a global basis looks absolutely shocking.”

💥 The GMO co-founder argues the S&P 500 may fall to 3000 points, representing a 38% decline from its December peak.

🛁 In January, Grantham sounded the alarm on a market “superbubble”, underscoring the dangerous combo of hugely overvalued stocks, bonds, and housing; soaring inflation and interest rate shocks; plus the Russia-Ukraine conflict, and more.

💸 He revealed a sizeable short position on the Nasdaq and junk bonds, expecting them to collapse further.

💀 Grantham finished his warning by stating, “this is a more dangerous looking moment in global economics than even the madness of the housing bubble of 2007.”

DID YOU KNOW?!

The Dow Jones Industrial Average fell 22.6% on a single day in 1987

With markets tumbling near 4% on Tuesday, we thought it’d be interesting to see how this tumultuous day compared to the worst single-day performances in history.

For context, the Dow fell 3.94%, the worst day since June 2020.

1. October 19, 1987: Black Monday (-22.6%)

2. March 16, 2020: Covid-19 Lockdowns (-12.93%)

3. October 28, 1929: Warning Signs of the Great Depression (-12.82%)

4. October 29, 2020: Black Tuesday (-11.73%)

5. March 12, 2020: The US Suspends Travel due to Covid-19 (-9.99%)

Where is the Dow headed by the end of 2022 (currently 30,822.42 points)?