📈 The Rapid Ascent of the Ghost Kitchen Industry

This recent IPO has the perfect recipe for success, and a massive waitlist to prove it

The global pandemic brought on many unique challenges and opportunities for all who sought to navigate this unprecedented period of uncertainty.

While many were forced to adapt in ways they never anticipated, shutting down operations almost instantaneously forced businesses to find solutions fast or risk bankruptcy.

This was particularly true for restaurants…

With almost no time to adjust, dine-in restaurants were required to close indefinitely, essentially leaving businesses to fend for themselves.

In the meantime, food delivery services like SkipTheDishes, Uber Eats, Grub Hub, and more, were making headlines due to record sales as consumers transitioned to the quarantine lifestyle.

Uber Eats saw revenues climb from $2.5 billion in 2019, before exploding to $8.3 billion in sales in 2021.

With so much demand, despite being locked down, it was clear that consumers' appetites were hungrier than ever and restaurants were ready to capitalize.

Even now, “post pandemic” consumers are still enjoying the convenience of delivery…

Delivery apps continue to see massive order volume, and the format for restaurants was completely disrupted by an entirely new model.

The ghost kitchen craze had officially commenced…

The Unprecedented Value of Ghost Kitchens

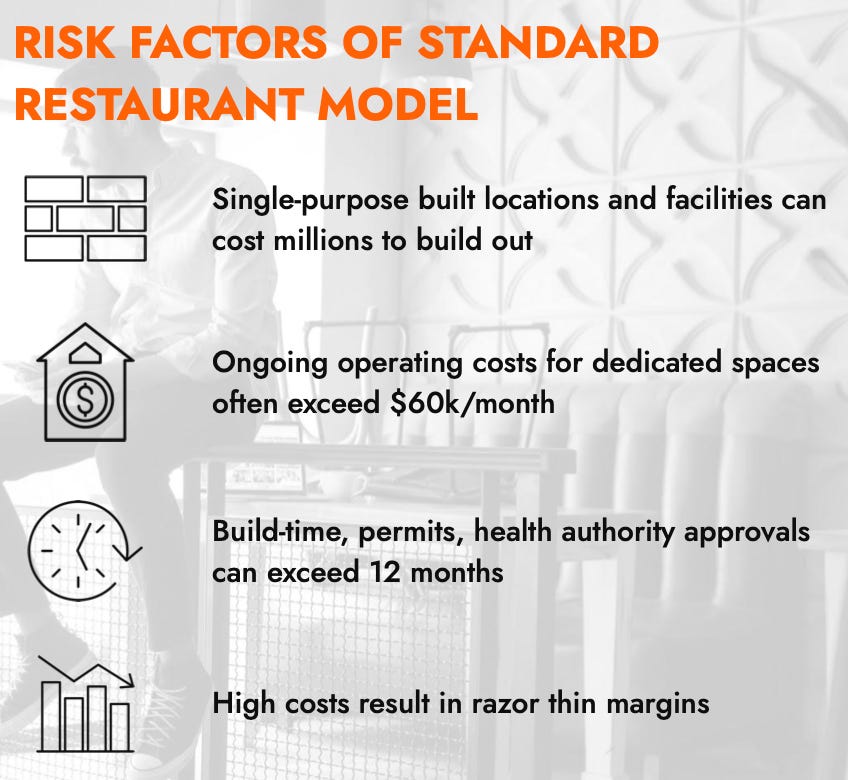

Dine-in restaurants are expensive.

With high overhead costs including the leasing or purchasing of property, staff salaries, food and beverage supplies, kitchen equipment purchases and maintenance, marketing, and more, it sure feels overwhelming for those wanting to run their own restaurant; especially if you are in the early stages.

Fortunately, ghost kitchens offer the perfect solution…

By leasing delivery only food preparation space on the perimeter of high population areas, restaurant owners can save a ton of money on both start up and operating costs.

With a startup cost of only $20,000 to $30,000, according to Soocial.com, this is an effective business model that helps restaurants maximize their profits, while maintaining a high-quality service.

According to Euromonitor Global Food and Beverage, the market is poised for success in the long run with the potential to capture more than $1 trillion in sales by 2030.

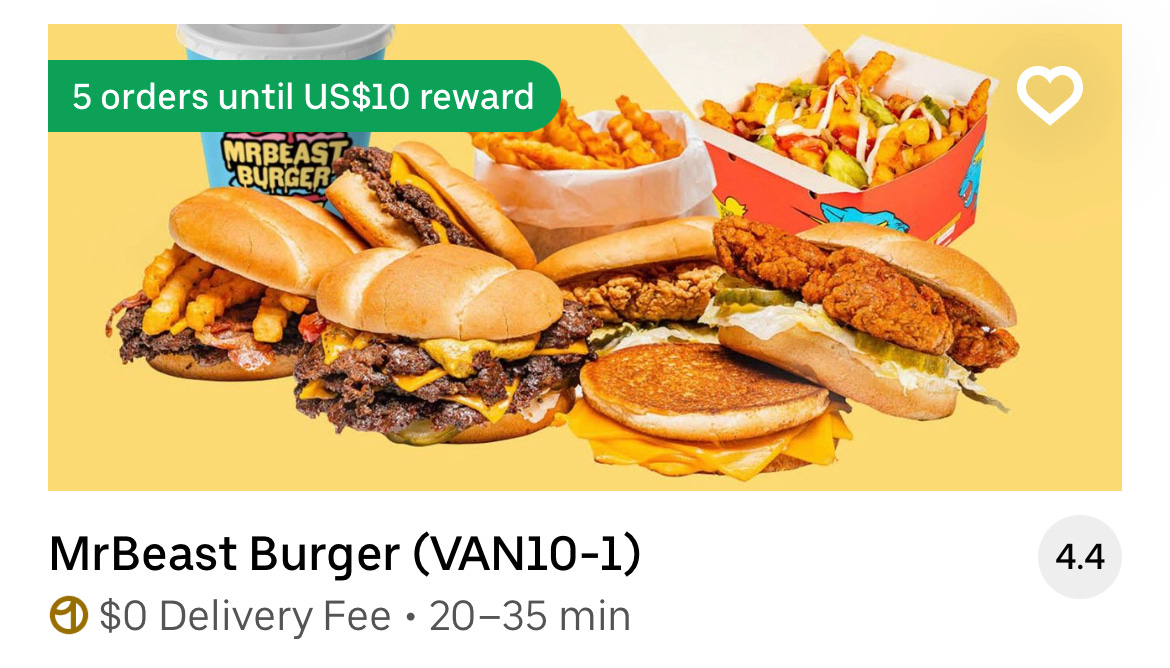

In fact, many things you order today on Uber Eats or SkipTheDishes come from ghost kitchens already, with no dine in option at all… and you wouldn’t even know!

Three Reasons to be Bullish on Ghost Kitchens

Here are three reasons why ghost kitchens are an excellent long-term play.

🎭 A significant shift in consumer behavior

Food ordering traffic has grown 300% faster than traditional dining in the past few years with 24% of Generation Z, and 21% of Millennials, ordering food 3-4 times per week. (Cloud Kitchens, Nearby Engineers)

📈 Massive global adoption

By 2030, ghost kitchens are predicted to hold a 50% share of the global drive-thru and takeaway foodservice markets. (Statista)

Currently, there are approximately 1,500 ghost kitchens in the US, 7,500 in China, and 3,500 in India; the total market value is projected to reach $71.4 billion by 2027, with a CAGR of 13.5%. (Statista)

🤑 Low operational costs

As mentioned earlier, the average ghost kitchen startup investment is between $20,000 and $30,000, with around $4,000 to $6,000 in monthly fees, which is significantly lower than their dine-in counterparts. (Go Cheetah)

🚨 You know by know we have an affinity for investing in small, high growth companies, but would you like to know exactly why we prefer Small-Caps over Large-Cap stocks? Check out our article: What is Small Cap vs. Large Cap

The Next Great Ghost Kitchen?

Coho Collective Kitchens (TSXV: COHO) is making waves in the Canadian ghost kitchen market by providing local businesses and reputable brands with the tools necessary to capitalize in this new rapid shift in consumer behaviour.

By utilizing its extensive network and marketing channels, strategic partners, high-class cooking equipment, and prime real estate locations, Coho offers clients an unequal advantage when it comes to sustainable restaurant growth.

With a community-first mindset, the company strives to create bountiful opportunities for all restaurants, big and small, and continues to seek new opportunities in lucrative markets.

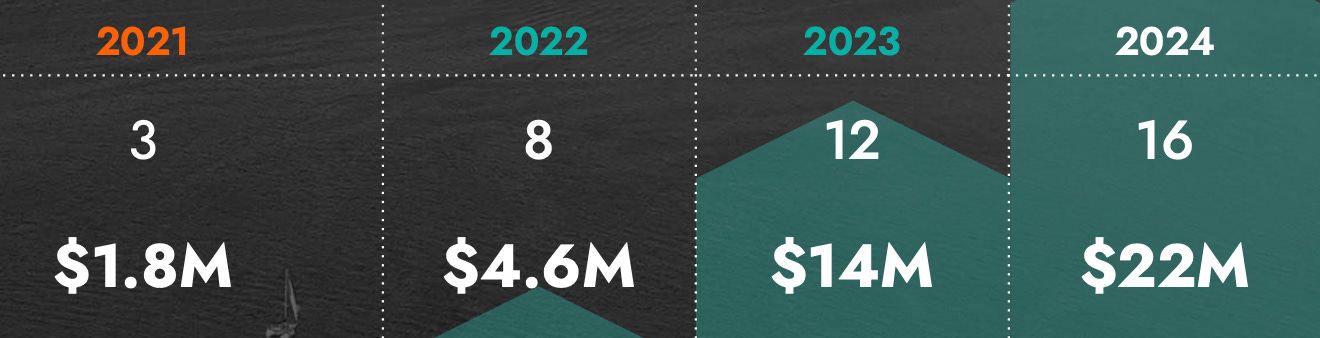

Here is Coho by the numbers:

🏦 Market Cap: $16.45 million

💲 Revenue (15 months ended, Q1 2022): $2,347,807

💰 Gross Profit (TTM): $1.69 million

🤝 Members: 100 members as of Q1, 2022; +400 currently on a waitlist!

💸 Average Revenue per Member: $1,410 in Q1, 2022

📍 Facilities: 6 active, plus an additional 2 being added in 2022

Coho was recently featured in an article on BNN Bloomberg, where they outline the story in greater detail.

Why Coho?

Coho Collective Kitchens is a leader in the Canadian marketplace, and one of the very first ghost kitchen operators to go public.

In the USA, the market is further along, with “Cloud Kitchens” (run by ex-Uber CEO Travis Kalanick) leading the charge with an eye popping $15 billion valuation.

However, Canada has a massive opportunity and with an already massive waitlist, Coho is positioned for rapid growth in the coming years.

Coho has projected to grow revenues from $1.8 million in 2021 to $22 million by 2024; which is an astounding CAGR of 130.35% in that period!

So how are they going to achieve this growth?

🌱 By continuing to innovate within facilities to maximize membership experience and profitability.

🌟 Increasing service offerings by expanding locations to support member businesses as they grow and require larger, more complex facilities.

🌎 Exploring international partnerships to support growth, activating new facilities with innovative food and entrepreneurial activity; Coho currently has partnerships with DoorDash and SkipTheDishes.

We had first invested in Coho during their seed financing at $0.15 per share, and then once again during the IPO at $0.30 per share.

As of market close today (August 24, 2022) COHO.V has a share price of $0.175, implying a market capitalization of only $16.45 million.

With 2022 coming to a close, and management forecasting to finish this year with $4.6 million in revenue, that implies a forward price to sales ratio of only 3.58 times, something we view as shockingly low for a company with potential to grow at such a rate!

*source: Coho’s April 2022 investor presentation

We’ve lined up an interview with CEO and Co-founder Andrew Barnes in the coming weeks, where we’re excited to dive much deeper into the story, and hear it first hand.

However, in the meantime get started by watching the presentation Andrew gave at our latest Deal Night live event back in June.

This is a stock you should add to your watchlist immediately and study thoroughly, because this is a company at the forefront of a trend that is only going to gain momentum over time.

🚨 For more details, check out the Coho Collective Kitchens’ investor relations page.

And as always, don’t forget to sharpen your skills by investing in your own knowledge!

🚨 If you are interested in learning how to successfully invest in micro-cap companies like this, check out our article: How to Make Money with Penny Stocks

This newsletter is written by Kevan Matheson, Founder & CEO of Edge Investments.

Before starting Edge, Kevan was an Institutional Analyst at RBC Global Asset Management, one of North America’s largest fund managers, with assets under management in excess of $400 billion.

After spending the majority of his career focused on large market capitalization public companies, Kevan became attracted to the risk/reward proposition of growth stocks and cryptocurrency.

In 2017 Kevan published a book on investing in cryptocurrency, where he speculated on the coming growth in NFTs and the underlying tokens that power their ecosystems.

Known in the growth stock community as Small Cap Kev, his current passion is finding stocks in disruptive industries like blockchain, psychedelic medicine, plant-based meat alternatives & much more.

This article was written in collaboration with Edge Investments’ analyst & writer, Declan O’Flaherty

Declan holds a Bachelor of Commerce from the University of Alberta and has over 2 years of experience investing in financial markets.

As a value investor, Declan embraces the lessons of Warren Buffett and his disciples when making investing decisions. With an emphasis on business fundamentals, his strategy focuses on finding stocks with excellent management, a competitive advantage, and those that are selling at discount to their real value.